High rubber prices to continue in 2011 as well

2012/3/21 5:15:06Domestic as well global rubber prices rallied to fresh historical highs due to heavy rainfall in top natural rubber producing areas of Southeast Asia like Thailand and India which may hit output for current year. Prices have also been supported by healthy demand from tyre industry and strong imports in China .Indian rubber supplies peak October-January, but this year unseasonal rains have been hindering tapping.

Rubber RSS-4 prices at Kochi market rose to fresh record of Rs 20,700 per quintal on Friday against Rs 16,200, three-months back and Rs 13,500 at the start of 2010. In the last two years natural rubber prices at Kochi have risen by 300% from Rs 69-70 per kg in January 2009 to record high Rs 207 per kg now. Such type of volatility was last seen in 1994-1998 when price rose from almost Rs 2,500 per quintal to near Rs 6,000 within two years and again fell sharply towards Rs 2,700 level in 1998.

The world's major rubber producers Thailand, Indonesia and Malaysia have been hit by heavy rains because of the La Nina phenomenon which cause drop in production.

All these have been supported by geopolitical tension in Korea, high crude oil prices. Singapore-based International Rubber Study Group has estimate that global rubber demand in 2010 may rise 12.7% to 23.9 million tonne.

Auto sales at China overtook that in the US in 2009 to become world largest auto market which is almost double in last four years from below 7 million units in 2006 to 12.99 million units in 2009 according to a report. While in India , sale of vehicles—including cars, utility vehicles, trucks, buses, motorcycles and scooters—jumped an annual 26.4% in 2009-10 to 12.3 million units, data from Society of Indian Automobile Manufacturers (SIAM) showed.

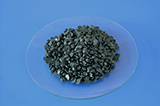

Natural rubber is produced from latex or field coagulum obtained from rubber trees. In India sheet rubber classified as RSS1, RSS2, RSS3, RSS4 and RSS5 is mostly produced and marketed in local markets.

Thailand is the world largest natural rubber producer in the world almost 3.5 million tonne a year followed by Indonesia 2.8 million tonne. Malaysia, India, Vietnam and China are the other major producer with less than 1 million tonne produce a year.

Also, Thailand and Indonesia is the world largest rubber exporter with yearly exports more than 2 million tonne, followed by Malaysia and Vietnam which export less than 1 million tonne.

Despite rainfall, overall global output of rubber for 2010 is estimated higher 6.6% by the Association of Natural Rubber Producing Countries(ANRPC) at 9.502 million tonne, this is after Indonesia, world second largest producer raised its production figure for 2010 at 2.85 million tonnes against the previous estimates of 2.59 million tonne.

India, world 4th largest producer is likely to produce around 8,50,000 tonne of natural rubber in 2010-11, down 4.8% from the earlier estimate of 8,93,000 tonne, after heavy unseasonal rains affected tapping.

India consumes nearly 1 million tonne of rubber annually, split roughly halfway between the tyre and non-tyre industries. However higher production estimates for Jan-Mar next year might offset some of the production deficit of current year.

Also in 2011, global rubber production is expected to rise by 4.2% to 9.898 million tonne.

However, this increase in output might not pressure on prices as demand from tyre makers is rising in every month and it is assumed that China, the world largest importer, would remain active next year as well and could import around 1.75 million tonne, compared to 1.72 million tonne in 2010.

Soaring rubber prices have also dented the tyre industry as natural rubber prices makes up about half the cost of a tyre and the industry has been grappling with falling profit margins as rubber prices soar due to a global supply crunch. India has cut import duty on natural rubber to 7.5% from 20% for shipments up to 40,000 tonne until March 31. The duty will be reinstated at whichever is the lower of 20% or Rs 20 per kg after that date. That would mean an import duty of 9-10% from April, at prevailing rates. However imports not possible as international prices is already higher than domestic rates.

Hot Product

Rubber Peptizer DBD

Rubber Peptizer DBD Light yellow powder, low poison, no-polluti...

Thiazoles--Rubber Accelerator MBT(M)

Used for NR, IR, SBR, NBR, HR and EPDM. One...

Rubber Peptizer DBD-40

Rubber Peptizer DBD-40 DBD-40 is a chemical peptizer for natural r...

Thiazoles--Rubber Accelerator MBTS(DM)

use as a plasticiser and/or retarder in pol...

Case

Improtant marketing in january

Improtant marketing in january

Sell to Spanish MBT 15tons on 2012.3.6

The company itself has the entitlement to import&export,sells a wide va...

Contact Us

Tel:86-371-63673288

86-371-63659198

86-371-63679318

86-371-86158658

Fax:86-371-63659728

Email: sale@doublevigour.com

Address: 1502, Building 5, Jinyin Modern City, Intersection of Guangdian South Road and Jingsan Road, Jinshui District, Zhengzhou City, Henan Province

Factory: Jijiashan Industrial Park, Heshan District, Hebi City,Hena, China

English

English 中文

中文 русский

русский español

español